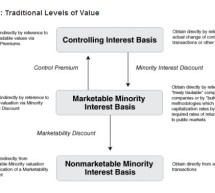

Current Practice Issue: Applying the Equity Method —Grant Thornton

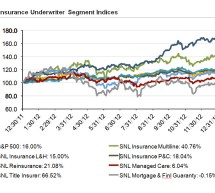

On the Horizon Offers Two Examples of Appropriate Ways to Apply FASB Guidance. Plus: New Guidance on Reporting Discontinued Operations and Not-for-Profit Entities Grant Thornton recently published a useful article on applying the equity method in its On the Horizon web-based publication, which also notes that the Fair Accounting Standards Board (FASB) has suggested new guidelines for reporting discontinue ...

Read more ›