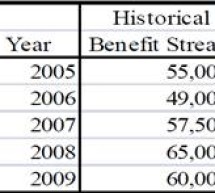

Be Careful When Using EBITDA for the Terminal Valuation Calculation

Be Careful When Using EBITDA for the Terminal Valuation Calculation If you’re going to construct consistent valuations, use earnings instead of cash flows in your calculations. Why is it important to be consistent? Because you have to calculate a discount rate based on one or the other. Richard Claywell explains. ...

Read more ›