The Impact of Inflation

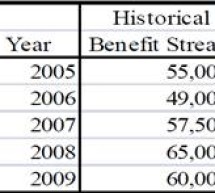

On Business Valuation The effects of inflation on consumers’ spending and psyche are well-known. The difficulties each causes in day-to-day life are often discussed. Inflation has affected everything from the cost of transportation to the cost of food and housing. What is less discussed, however, is how the current inflationary period is affecting small business owners and their companies. In this article t ...

Read more ›